Hi readers, welcome to our Connect33 Q2 newsletter where we cover Latin America technology trends, expansions, and our LatAm jobs section. The inspiration for this newsletter came from our experience leading international expansions for tech companies like Uber, Terminal, Twilio, and more. During those endeavors, delivering concise, on-the-ground insights to headquarters was crucial for cross-functional alignment and successful launches.

In some company news – we’re excited to announce that we’ve launched our Software Outsourcing Partner service for companies in search of a software development partner across Latin America. Receive a shortlist of top firms based on your needs and gain immediate access with Connect33. We handle all the due diligence at no cost to you – contact us below for more information. ¡Vámonos!

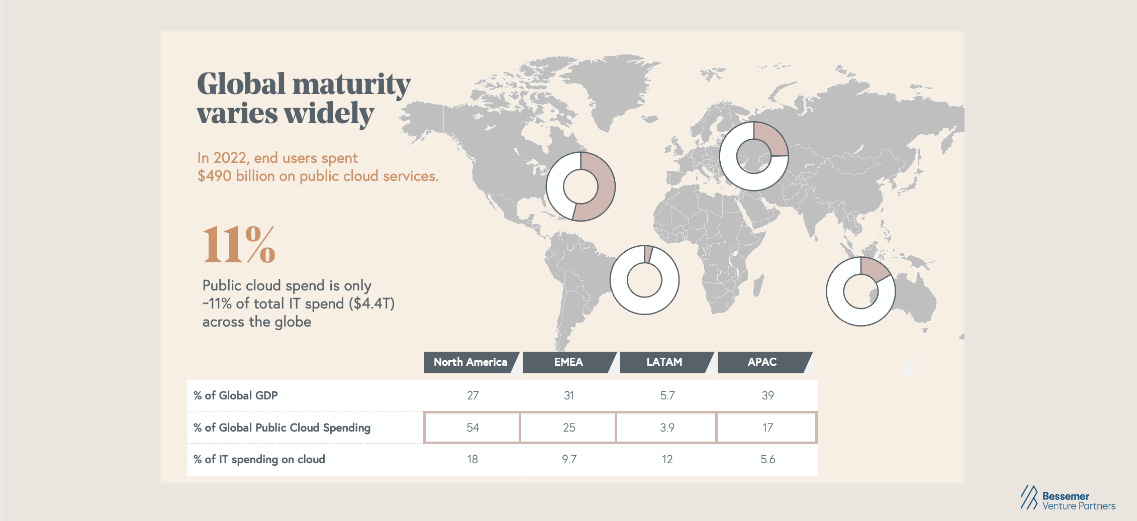

Cloud Trends: The cloud business model is still one of the most efficient business models to ever be invented. Massive rates of digital transformation since 2020 have brought the cloud economy to a major inflection point where the majority of all software is in the cloud. When we look at different markets across the globe in 2023, there are still growing opportunities for cloud adoption and entrepreneurship across the globe. Cloud spending grew 85% in Latin America, including Mexico (LATAM), and 35% in Asia and the Pacific (APAC).

Our take: Although Bessemer’s State of Cloud 2023 report lacks an in-depth analysis of Latin America – it does confirm the rapid growth of the cloud market in the region due to digital transformation. However, the current market share remains relatively low at 3.9%, showing a 1.3% increase year over year compared to global public cloud spending in other regions.

In 2022, we highlighted notable investments made by well-known US tech players such as Google, Oracle, Snowflake, and Samsara, as well as local players including Ascenty (BRA), Seak (BRA), KIO (MX), VTEX (BRA), and TOTVS (BRA). These investments clearly indicate that the cloud economy in Latin America is just beginning to flourish, and we anticipate further expansions and continued growth.

The European Expansion Report: This study analyzed 210 VC-backed B2B Software companies that expanded into Europe since 2010 gathering over 300,000 data points on these companies’ hiring patterns, their HQ location selection, and their leadership hires, to inform the insights and conclusions in this report.

Our take: You might wonder why we’re highlighting a report on European expansion and the reason is that our team drew many parallels to trends we’ve seen on the Latin America expansion front.

Like Frontline’s analysis – we have observed stability in engineering-focused expansions compared to sales-focused expansions since our inception in 2020. Building high-performing engineering teams across Latin America has remained steady, while sales-focused expansions have slowed.

Furthermore, just as London, Dublin, and Amsterdam account for 90% of companies' headquarters in Europe, we've noticed a similar concentration in Latin America. São Paulo and Mexico City have become popular choices for companies setting up operations in the region. Felicidades to Frontline Ventures for putting together this exceptional report.

Rappi, the Colombian delivery company, acquired Box delivery in Brazil as it aims to meet growing demand from restaurants in the country. (Bloomberg Linea)

Bring IT, an Oracle NetSuite Alliance Partner, acquired two Brazilian companies to secure a global presence and support growing customer demand. (Business Wire)

Pentera, an Israeli cybersecurity company, announced plans to expand into Mexico and Brazil. (PR Newswire)

KIO, the Mexican data center firm, is expanding operations to Monterrey, Mexico all while also increasing investment in Panama, Guatemala, Colombia, and Spain. (Reuters)

Whatsapp [NYSE: META] began rolling out payments in Brazil. (Bloomberg Linea)

Globant [NYSE: GLOB] acquired French digital transformation company Pentalog, to further accelerate its expansion in Europe. (PR Newswire)

Revolut, the UK-based fintech, marked its debut in Latin America by launching in Brazil. (Fintech Futures)

Brex, the US fintech, announced new global capabilities to support US multinationals operating in Brazil, Mexico, and others. (Brex)

Eucon, a US-based digital pioneer for data and process intelligence, announced the opening of its first LatAm office in Mexico City. (PRWeb)

Moove IT and December Labs, two Uruguayan software development companies announced a merger to become Qubika. (Business Wire)

Microsoft [NYSE: MSFT] announced the expansion of its Airband partnership to provide high-speed internet access to 40M people across LatAm and Africa. (Microsoft blog)

Ebury, the London-based fintech, acquired Brazilian fintech Bex as it aims to begin investing heavily across Latin America. (Pymnts)

Liquido, the US-based paytech company, launched in Latin America following a US $26mn funding round. (Fintech Futures)

Lemon, an Argentinian crypto company, expanded into Mexico (LatamList)

Shein, the Chinese fast fashion giant, announced plans to build a Mexican factory to service the Latin America region. (Reuters)

Tata Consultancy, the IT service multinational, announced the opening of a new office in Monterrey, Mexico its fourth office in the country. (Mexico News Daily)

Strike, the global money app startup, announced the expansion of its ‘Send Globally’ product to Mexico in order to serve the largest market for remittances from the US. (Business Wire)

Oracle [NYSE: ORCL] announced plans to open a new data center in Monterrey, Mexico as nearshoring demand surges. (Milenio)

TikTok, the social media platform, stepped up its Latin America expansion with new office openings in Colombia and Argentina. (Bloomberg Linea)

Digibee, an integration platform as a service company, raised US $60mn to further expand into Latin America (Business Wire)

Visa [NYSE: V] announced its acquisition of Brazilian payments infrastructure startup Pismo for US $1bn. (Techcrunch)

Stripe opened an operations center in Mexico as part of their continued expansion and plans to build a 100-person team over the next three years. (Iupana)

Additional stories we’re reading:

10 Most Innovative Companies in Latin America 2023 (Fast Company)

Which LatAm Countries Rank Highest on the Economic Complexity Index? (Linea)

Github CEO Sees Brazil’s Potential as a Growing Market for Developers (Linea)

Next Wave of Remote Work is About Outsourcing Jobs Overseas (WSJ)

Latin America Shows Investment Promise But Challenges Remain (Forbes)

Clara secures $60M amid rapid transaction growth in LatAm (TechCrunch)

Job Board

LatAm-focused roles at top tech companies.

WISE is hiring a Senior Product Manager Brazil

Revolut is hiring a Head of HR - US & LATAM

Datadog is hiring a Manager, Enterprise CS LATAM

Darktrace is hiring a Customer Success Director - LATAM

Chegg is hiring a Senior BD Manager LATAM

Thanks for reading Connect33 Quarterly!