Hi Connect33 readers — we’re back with our third edition of Connect33 Quarterly covering Latin America market trends, recent tech expansions, and Connect33 news. During Q3 we observed a very active tech expansion period, hyperinflation in Argentina, and a runoff election in Brazil. ¡Vámonos!

Market Trends

Software Developer Salaries: The median annual salary for remote Latin American software developers working for local companies is $12,000 (all data in USD), while those working internationally earn $26,400. For the 64% of developers working remotely for a US-based company, the median wage is $40,000.

Our take: This article helps myth-bust the many tech salary reports that under-quote LATAM salaries by relying solely on local company compensation data. While LATAM tends to be a lower-cost employment option than the US, Canada, and EMEA, international companies, especially US-based, have officially disrupted the LATAM tech talent market by paying upwards of 2X above the local average. If you’re looking for tech talent with experience working remotely for internationally-based companies, you might have to pay more than what most published reports say.

Atlantico Report 2022 Report: Atlantico’s 2022 Latin America Digital Transformation Report with new data and research on fintech, web3, software, remote work, and much more released in September.

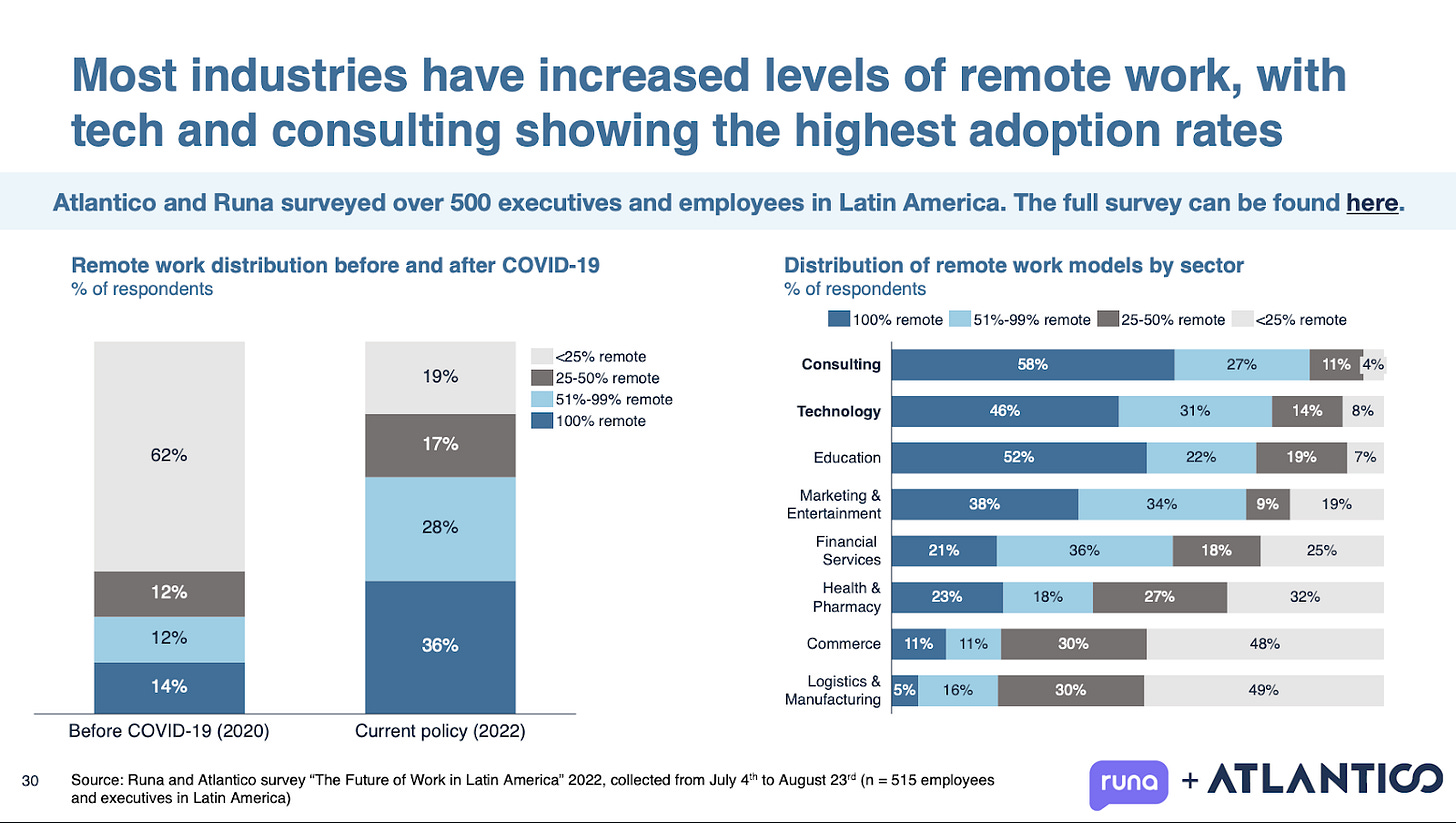

Our take: This 200-slide report is a must-read for anyone interested in understanding Latin America’s investment & tech landscape. We’ve chosen to highlight two particular slides that we felt are most relevant to our audience. You can watch the live report presentation here.

The surge in Internet Penetration is a big reason we remain bullish on the region. With this rapid growth in internet penetration and smartphone adoption (driven primarily by Android), the region continues to be primed for digital transformation and foreign investment.

The shift to remote work in Latin America was welcomed with open arms, especially by software engineers and other technology professionals. Our team at Connect33 has experienced the challenges that come with scaling a team across Latin America and often advises our clients to be open to remote or hybrid working environments when building their teams.

LatAm SaaS Market Report: Latin America is one of the fast-growing SaaS markets worldwide, and its evolution is likely to continue. The CAGR forecast reveals a hyper-growth of 27.2% by 2026, reaching USD $15.9 billion, with Brazil and Mexico as the major markets in the region.

Our take: The rapid digitalization of Latin America has brought many international tech incumbents to the region across remote desktop software, live chat software, video conferencing, e-commerce, collaboration, and project management. We believe the influx of SaaS companies will continue given the opportunity that exists within Latin American enterprises for digital transformation and process improvement, and the SaaS companies that successfully capitalize on this opportunistic market will be those who drive a strategic, locally-tailored Go-to-market approach.

Q3 Expansion Activity

July

Google (NASDAQ: GOOGL) plans to open a new cloud region in Mexico to meet the growing demand for its cloud services. The Mexico office will be its third LatAm office along with São Paulo, Brazil, and Santiago, Chile, and follows their Q2 announcement for a $1.2B investment across Latin America.

Cognite, a global leader in industrial software will launch new offices in Colombia, Argentina, and Brazil to support digitization in LatAm. Cognite’s LatAm partners include Microsoft, Accenture, and SKF.

TTEC (NASDAQ: TTECC), one of the largest customer (CX) technology and services innovators for end-to-end digital CX solutions, announced the opening of its first delivery center in Colombia, initially focused on telecommunications clients.

Evalueserve, a leading global analytics partner to more than 30% of Fortune 1000 firms, announced the opening of its first Colombia office as part of a larger in-country strategy.

August

Serviceaide, a global provider of modern IT and enterprise service management solutions, expands into Mexico, LatAm’s second-largest IT market.

Tubi, a Fox-owned FAST platform with a presence in Mexico, will expand into five additional LATAM countries: Costa Rica, Ecuador, El Salvador, Guatemala, and Panama. Tubi offers viewers a mix of locally-produced content, Spanish-language favorites, and Hollywood titles on Apple TV, Google TV, and Roku in addition to several other TV device options.

September

Oracle (NYSE: ORCL) opens its fifth LatAm cloud region and first in Colombia in partnership with Claro. This follows Oracle’s opening of their cloud region in Mexico highlighted in our Q2 newsletter.

Amazon Web Services Mexico (NASDAQ: AMZN) to open a local hub in Mexico City along with offices in Guadalajara and Monterrey to boost bandwidth for its clients.

Shopee (NYSE: SE) shuts down operations in 4 countries across Latin America due to elevated macro uncertainty. The news comes just 2 months after Shopee announced the opening of five new distribution centers in Brazil Latin America is Shopee’s second largest region accounting for 18.6% of revenue.

Snowflake (NYSE: SNOW), the Data cloud company, announces Mexico expansion. The company is planning to hire across Latin America in an effort to increase sales and its client base which includes Cemex, Deacero, Reworth, and others.

Western Union (NYSE: WU) prepares for Latin America expansion via its strategic acquisition of the Brazilian digital wallet, Te Enviei.

Connect33 News

Our case study with Atrium is now live — find out how Atrium scaled their LatAm engineering team in 4 months here.

Additional stories we’re following: