Connect33 Newsletter, Q3 2023

4-minute read

Hi readers, welcome to the Q3 edition of Connect33 Quarterly where we cover Latin America technology trends, expansions into the region, and a US-based, LatAm jobs section. In this edition, we look into Atlantico & McKinsey’s yearly reports on LatAm’s digital transformation as well as highlight a $1 bn AI investment, the opening of LatAm’s largest last-mile delivery center, and a number of fintech acquisitions.

In other news, we’re gearing up for the release of our 1st edition LatAm Founder Report featuring companies like Uber, Rappi, and Nubank that have become ‘founder factories’ for Latin America. If you’re interested in receiving this report please reply to this email to be added to the distribution list. ¡Vámonos!

Atlantico Digital Transformation Report: Atlantico, a VC firm in Latin America, released their 2023 report highlighting Latin America’s Digital Transformation. This report offers an extensive overview of Latin America’s tech ecosystem covering everything from macroeconomic factors, to venture capital funding, to industry analysis for fintech, e-commerce, AI, and much more.

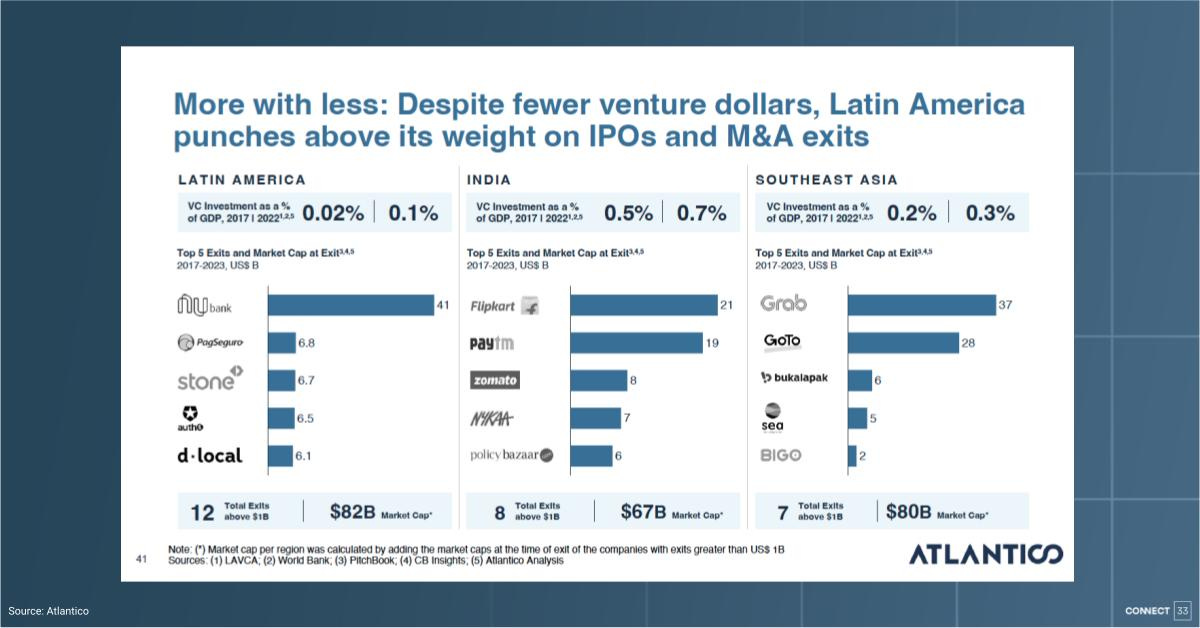

Our take: This is our second year highlighting Atlantico’s report and this time around we’ve chosen to hone in on the M&A and IPO landscape where we’ve seen a maturing market in which companies are cashing out.

While Latin America still lags behind countries like the US & China in terms of tech as a % of total market cap, the region’s tech sector making a recovery after a dip in 2022. Unicorn companies like Kavak, iFood, Rappi, QuintoAndar, Creditas, and others are beginning to set their sights on an IPO. In addition, the pre-IPO market is crowded, and there is significant activity in the M&A landscape following Visa’s acquisition of Pismo in Q2.

LATAM Digital Report: The 4th edition of the McKinsey report surveyed 200 top Latam startups across 8 countries, and 15 industries grouping insights across 4 main areas 1) Funding & Investor Relations 2) Product & Growth Strategy 3) Profitability & Efficiency 4) People & Culture.

Our take: It’s tempting to view 2022 (& first half of 2023) as a major setback for the startup ecosystem in Latin America, given the slowdown in VC funding, layoffs, and down rounds. However, it’s important to take a step back and recognize just how much progress has been made – the number of unicorns increased threefold between 2019 and 2023, 150+ new LatAm-based VCs emerged allowing more access to capital, and the region is ripe for IPO and M&A activity.

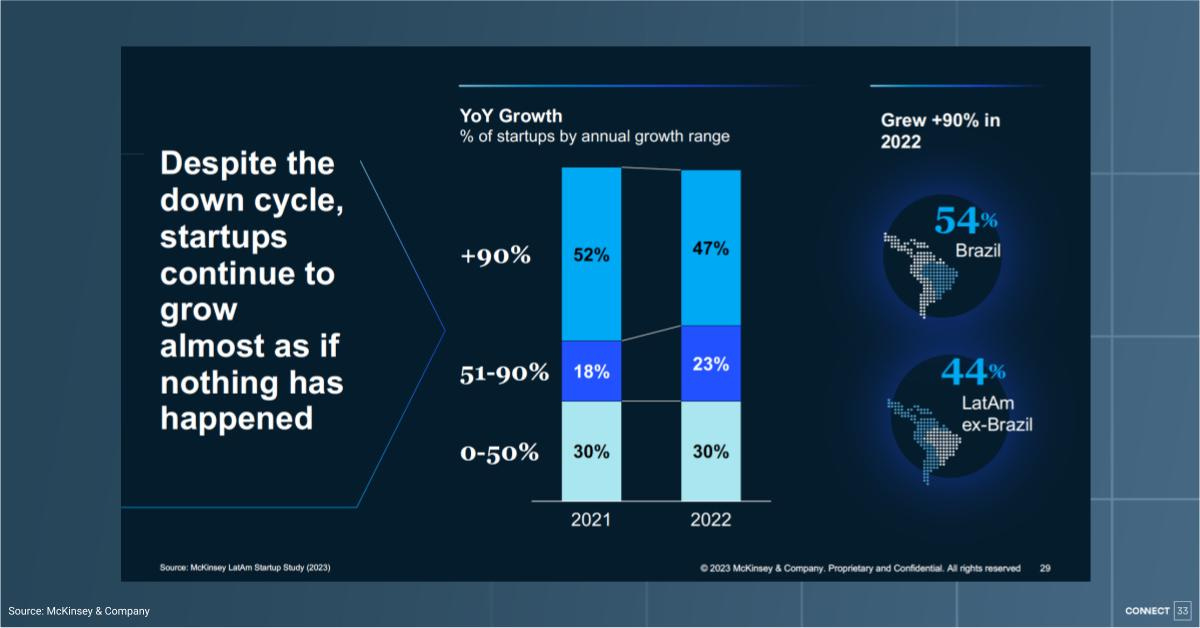

Down Cycles & Growth: Even with startups facing significant down rounds (33%) and layoffs (40%) – market cycles are nothing new and many startups have successfully taken this punch and continued on a strong growth trajectory. These are signs of seasoned entrepreneurs and a maturing market with Brazil leading the way.

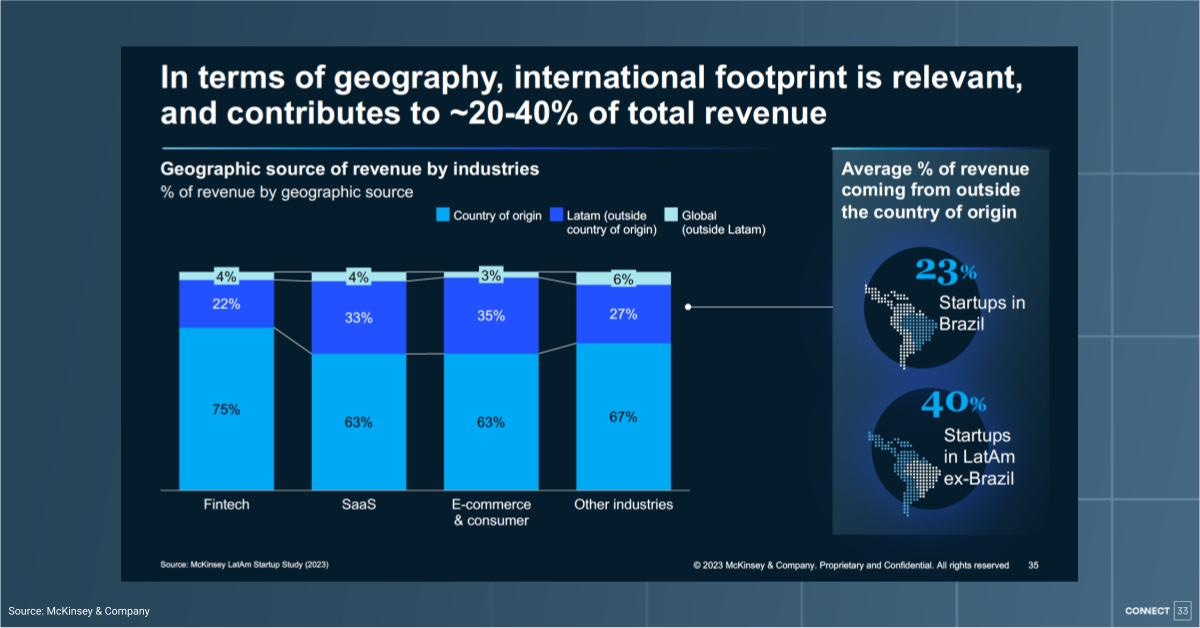

International Revenue %: Secondary markets account for 29% of revenue on average for startups across fintech, SaaS, E-commerce, and other sectors with country of origin accounting for 67% and countries outside of the region a 4%. This proves that international expansion has become a significant growth driver for LatAm startups and that expanding across the region isn’t as hard to crack as it once was.

Xertica, the cloud-based cybersecurity and data protection startup, announced its expansion into Brazil. (Latam List)

Marqeta (NASDAQ: MQ), the modern card and payment solutions company, announced its expansion into Brazil via a strategic partnership with Fitbank, a Latin American banking as a service platform. (Crowdfund Insider)

Evertec (NYSE: EVTC), a leading full-service transaction processing business acquired Sinqia, a provider of software solutions for financial institutions to further expand its presence in Brazil. (Business Wire)

Bdeo, a Spanish insurtech startup announced a €7.5 mn investment for its international expansion into Europe and Latin America. (Contxto)

Globant (NYSE: GLOB), the IT and software company, announced plans to invest $1bn USD and double its workforce to build out its artificial intelligence operations in Latin America. (Bloomberg)

Amazon (NYSE: AMZN) announced plans to launch a credit card in partnership with Brazil’s Banco Bradesco in an effort to improve the shopping experience for its customers in the country. (Reuters)

Intel (NASDAQ: INTC), the US chip manufacturer, announced that will it invest $1.2 bn in Costa Rica over the next two years. (Reuters)

Clara, one of Mexico’s most successful fintech startups, moved its headquarters from Mexico to Brazil as it aims to launch new products in the country. (Reuters)

Rapyd, the London-based fintech as a service provider, announced the acquisition of PayU’s Global Payment Organization business which will enhance its ability to offer its service across Latin America and parts of Europe. (TechCrunch)

Howdy, a talent sourcing and management provider helping US companies hire tech workers in Latin America, announced the acquisition of Geekhunter, a Brazilian talent marketplace. (PR Newswire)

Revolut, the European fintech, off its recent Brazil expansion, announced that its ‘light app’ will now allow customers to transfer funds to another Revolut customer for free. The app is now live in Chile with further expansion expected within Latin America, a key region for the company. (Crowdfund Insider)

Dock, the Brazilian fintech announced that Tenmp, Chile’s largest digital bank with 2.2 million customers is now a customer marking its ninth market across Latin America. (PR Newswire)

Citigroup (NYSE: C), the US banking group, announced it acquired a stake in Rextie, a Peruvian foreign exchange startup marking its first fintech investment in the region (Reuters)

ServiceNow, the California-based IT company, is looking to capitalize on the generative AI wave by growing its major client base in the region. (BNAmericas)

Amazon (NYSE: AMZN) opened its largest last-mile delivery center in Latin America in Mexico City in an effort to continue its growth trajectory and gain market share from Mercado Libre (MELI) and Walmart (WMT) (Reuters)

Gorilla Technology Group (NASDAQ: GRRR), a global provider of AI-based edge video analytics, IoT technologies, and security convergence, announced a partnership with Protactics, a Colombian-based enterprise specializing in IT solutions for security and defense equipment in Latin America. (Yahoo Finance)

Ripple Labs, the troubled US fintech, announced that its Liquidity Hub expanded into Australia and Brazil, giving local businesses a way to manage their crypto liquidity. (Coinspeaker)

Relex Solutions, a provider of retail and supply chain software solutions, announced a partnership with OXXO to help increase the accuracy of their product demand forecasts across all 22,000 stores in Mexico. (Retail Times)

Ebanx, the Brazilian fintech company, announced plans to expand to India by year’s end. (Bloomberg)

Additional reads:

How LatAm is Quickly Becoming A Leading Supplier of Technology Talent To North America (Forbes)

Latin America’s Startups Primed for Sale, IPOs (Bloomberg)

LatAm’s Startup Funding Continued to Fall Sharply in the First Half of 2023 (Crunchbase)

The Bullish Case for LatAm, According to Marcelo Claure and Shu Nyatta (Linea)

These Are the Sectors and Countries Leading LatAm’s Nearshoring Boom (Linea)

Nubank is leaving US Digital banks in the dust (Forbes)

NVIDIA Aims to Bolster its Presence in Brazil and Latin America (Linea)

Job Board

LatAm-focused roles at US tech companies.

Airbnb is hiring a LatAm Connections & Media Activations Lead

Remitly is hiring a Product Manager, Global Expansion

TikTok is hiring a Transfer Pricing Assistant Manager

Braze is hiring a Senior Product Marketing Manager

Udemy is hiring an Emerging Account Executive, Brazil

WISE is hiring a Senior Product Manager, Brazil

Signifyd is hiring a Senior Manager, Chargebacks

Veraka is hiring a Senior Manager / Director of Growth

HoYoverse is hiring a LatAm Public Relations Manager

Acer is hiring a Sales Manager

Datadog is hiring a Customer Success Associate

Snyk is hiring a Sr. Customer Acquisition Account Executive

Miro is hiring a Channel Sales Manager

Abbvie is hiring a Director Market Access

MercadoLibre is hiring a Sr. Analyst Cross Border Account Executive

Thanks for reading Connect33 Quarterly!